The massive Cloud-native Application Protection Platform Market Size is a direct indicator of the technology's strategic importance in the modern digital landscape. To fully appreciate its scale, it's necessary to deconstruct the market into its core constituent segments, each representing a multi-billion-dollar opportunity in its own right. The market's overall valuation is projected to reach an impressive $71.92 billion by 2035, a figure that reflects the comprehensive nature of these platforms. This growth is propelled by an anticipated CAGR of 21.72% over the 2025-2035 decade, showcasing strong demand across all components of the CNAPP framework. The total market size is a composite of different security capabilities, deployment models, and customer segments, all converging into a single, cohesive market focused on protecting cloud-native applications throughout their lifecycle.

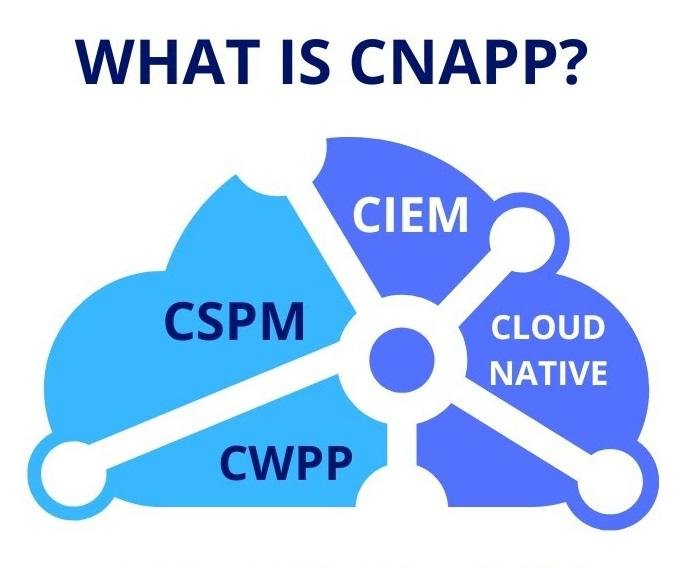

The largest component contributing to the market size is the consolidation of what were once standalone security categories. This includes Cloud Security Posture Management (CSPM), which focuses on detecting misconfigurations and ensuring compliance, and Cloud Workload Protection Platforms (CWPP), which secure the runtime environment of VMs, containers, and serverless functions. Another significant and fast-growing component is Cloud Infrastructure Entitlement Management (CIEM), which manages permissions and entitlements for human and machine identities to enforce least privilege. More recently, capabilities like Infrastructure as Code (IaC) scanning and Kubernetes Security Posture Management (KSPM) have been integrated. The total market size represents the combined value of these integrated capabilities, with customers increasingly preferring a single platform that provides a holistic view rather than purchasing multiple point solutions.

Breaking down the market size by organization type reveals two key segments: large enterprises and small-to-medium-sized enterprises (SMEs). Historically, large enterprises have been the primary adopters of CNAPP, as they have the most complex multi-cloud environments, the most stringent compliance requirements, and the largest security budgets. They continue to represent the largest share of the market by revenue. However, the SME segment is the fastest-growing part of the market. The availability of scalable, SaaS-based CNAPP solutions has made this enterprise-grade security accessible to smaller organizations. As SMEs increasingly become targets of sophisticated cyberattacks and recognize the need to secure their cloud applications, their adoption of CNAPP is accelerating, significantly expanding the total addressable market and contributing to the overall market size.

From a regional perspective, North America currently holds the largest share of the CNAPP market size. This is due to the high concentration of major cloud providers and early adopters of cloud-native technologies in the region, as well as a mature regulatory environment that drives security spending. However, the European and Asia-Pacific regions are expected to exhibit the highest growth rates in the coming years. Rapid digitalization, increasing cloud adoption, and the implementation of stringent data privacy regulations (like GDPR in Europe) are fueling a surge in demand for CNAPP solutions in these regions. This geographic expansion is a key factor that will contribute to the market reaching its projected global size, as cloud security becomes a universal priority for organizations around the world.

Explore Our Latest Trending Reports:

Dynamic Data Management System Market