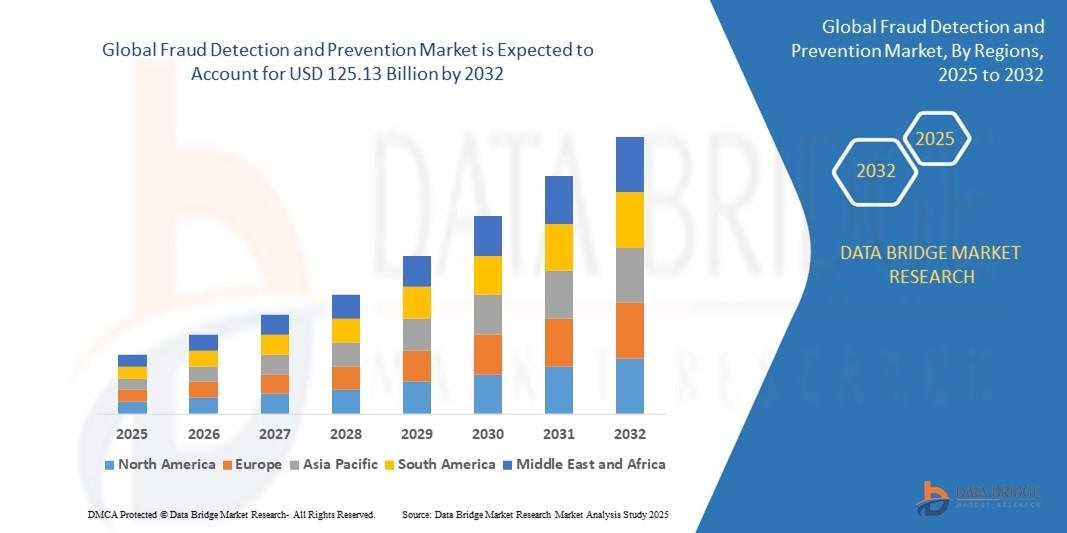

"Global Executive Summary Fraud Detection and Prevention Market Market: Size, Share, and ForecastThe global fraud detection and prevention market size was valued at USD 33.63 billion in 2024 and is expected to reach USD 125.13 billion by 2032, at a CAGR of 17.85% during the forecast period

To gain meaningful market insights and thrive in this competitive market place, Fraud Detection and Prevention Market Market survey report plays a key role. The report takes into account the market type, organization size, accessibility on-premises and the end-users’ organization type, and accessibility at global level in areas such as North America, South America, Europe, Asia-Pacific, Middle East and Africa. Fraud Detection and Prevention Market Market report displays several parameters related to Fraud Detection and Prevention Market Market industry which are systematically studied by the experts. These parameters mainly include latest trends, market segmentation, new market opening, industry forecasting, target market analysis, future directions, opportunity identification, strategic analysis, insights and innovation.

The universal Fraud Detection and Prevention Market Market report helps make known uncertainties that may crop up due to changes in business activities or introduction of a new product in the market. This market research report provides thorough information about a target markets or customers. Moreover, it takes into account both qualitative and quantitative techniques of market analysis. Focus groups and in-depth interviews are included for qualitative analysis whereas customer survey and analysis of secondary data has been carried out under quantitative analysis. It helps companies to take decisive actions to deal with threats in the niche market. An excellent Fraud Detection and Prevention Market Market report proves to be a sure option to help grow the business.

Stay ahead with crucial trends and expert analysis in the latest Fraud Detection and Prevention Market Market report.Download now:

https://www.databridgemarketresearch.com/reports/global-fraud-detection-and-prevention-market

Fraud Detection and Prevention Market Industry Overview

Segments

- On the basis of solution, the global fraud detection and prevention market can be segmented into fraud analytics, authentication, and GRC.

- Based on service, the market can be categorized into professional services and managed services.

- By application, the market can be divided into insurance claims, electronic payment, and mobile payment.

- In terms of deployment mode, the market can be classified as cloud and on-premises.

- Considering the organization size, the market segments include small and medium-sized enterprises (SMEs) and large enterprises.

- Geographically, the market is segmented into North America, Europe, Asia-Pacific, South America, and Middle East & Africa.

Market Players

- IBM

- Fiserv

- Oracle

- SAS Institute

- Experian

- LexisNexis Risk Solutions

- ACI Worldwide, Inc.

- FICO

- Dell EMC

- Equifax

- SAP

- BAE Systems

- NCR Corporation

- FIS

- DXC Technology

- Featurespace

- Toyota Tsusho

- Signifyd

- Kount

- Simility

The global fraud detection and prevention market is witnessing significant growth due to the increasing focus on mitigating fraud-related losses across various industries. The market is driven by the rising adoption of digital payment methods, which are prone to fraud, leading to the need for advanced fraud detection and prevention solutions. Fraud analytics segment is expected to witness substantial growth as organizations increasingly leverage data analytics to detect and prevent fraudulent activities. The authentication segment is also anticipated to grow as companies invest in biometric authentication and multi-factor authentication solutions to enhance security.

In terms of services, the demand for managed services is expected to rise as organizations look to outsource their fraud detection and prevention processes to specialized service providers. The insurance claims application segment is projected to experience significant growth as insurance companies deploy fraud detection solutions to combat fraudulent claims. The mobile payment segment is also expected to contribute to market growth with the increasing adoption of mobile wallets and contactless payment methods.

The cloud deployment mode is gaining traction in the market due to its scalability, flexibility, and cost-effectiveness. Small and medium-sized enterprises (SMEs) are increasingly investing in fraud detection and prevention solutions to safeguard their businesses from financial losses. North America is expected to dominate the market due to the presence of key market players and the high adoption of advanced technology solutions across various industries.

The global fraud detection and prevention market is poised for continued growth as businesses across industries intensify their efforts to combat fraud and financial losses. One emerging trend in the market is the increasing integration of artificial intelligence (AI) and machine learning (ML) technologies into fraud detection solutions. These advanced technologies enable the automation of fraud detection processes, leading to more efficient and accurate identification of fraudulent activities. Moreover, the adoption of real-time monitoring and analysis capabilities is becoming crucial for organizations to stay ahead of evolving fraud tactics.

Another key driver for market growth is the rapid digital transformation taking place in various sectors, including banking, financial services, and insurance. As organizations shift towards digital channels for transactions and customer interactions, the risk of fraud has escalated, driving the demand for sophisticated fraud detection solutions. Additionally, the regulatory landscape is evolving, with stringent compliance requirements mandating robust fraud prevention measures, further fueling market growth.

Vendor competition in the global fraud detection and prevention market is fierce, with key players focusing on innovation and strategic partnerships to gain a competitive edge. Collaboration with technology providers specializing in cybersecurity and data analytics is becoming common to develop comprehensive fraud detection solutions. Furthermore, market players are expanding their geographic footprint to tap into new growth opportunities in emerging markets.

As the market continues to evolve, customization and scalability are becoming critical factors for organizations evaluating fraud detection and prevention solutions. Tailoring solutions to specific industry requirements and offering flexible deployment options will be crucial for vendors to meet the diverse needs of businesses operating in a digital ecosystem. Overall, the global fraud detection and prevention market is poised for dynamic growth driven by technological advancements, changing consumer behavior, and evolving regulatory landscapes. Organizations that invest in robust fraud detection solutions tailored to their specific needs will be better equipped to mitigate risks and safeguard their financial assets in an increasingly digital world.The global fraud detection and prevention market is experiencing significant growth propelled by various factors that are reshaping the landscape of fraud prevention strategies across industries worldwide. With the rise in digital payment methods, organizations are facing heightened risks of fraudulent activities, leading to an increased demand for advanced solutions to mitigate financial losses. The incorporation of fraud analytics is expected to play a pivotal role in detecting and preventing fraud as companies leverage data insights to enhance their fraud detection capabilities.

Managed services are witnessing a surge in demand as businesses seek to outsource their fraud prevention processes to specialized service providers, enabling them to focus on core operations while benefiting from expertise in fraud detection. The insurance claims application segment is poised for substantial growth as insurance companies invest in robust fraud detection technologies to combat fraudulent claims effectively. Additionally, the mobile payment sector is anticipated to contribute significantly to market expansion, driven by the growing adoption of mobile wallets and contactless payment methods.

Cloud deployment is gaining momentum in the market owing to its scalability, flexibility, and cost-efficiency, offering organizations the agility to adapt to evolving fraud scenarios effectively. In parallel, small and medium-sized enterprises are increasingly investing in fraud detection solutions to safeguard their businesses from potential financial risks, thereby driving market growth. North America emerges as a dominant player in the global market, supported by the presence of key industry players and the extensive adoption of advanced technologies across diverse sectors.

Furthermore, the integration of artificial intelligence and machine learning technologies into fraud detection solutions is a notable trend shaping the market, empowering organizations with automated processes and enhanced accuracy in identifying fraudulent activities. Real-time monitoring capabilities are becoming indispensable for businesses seeking proactive fraud prevention measures, enabling them to stay ahead of evolving fraud tactics effectively.

In conclusion, the global fraud detection and prevention market are set for continuous expansion driven by technological innovations, changing consumer behaviors, and regulatory imperatives. As businesses navigate the complexities of a digital ecosystem, the customization and scalability of fraud detection solutions will be paramount in addressing industry-specific requirements and ensuring comprehensive protection against fraudulent activities. Market players are expected to focus on innovation, strategic partnerships, and geographic expansion to gain a competitive edge in a rapidly evolving landscape characterized by dynamic market forces. Embracing advanced fraud detection solutions tailored to specific business needs will be crucial for organizations to mitigate risks, safeguard financial assets, and thrive in an era defined by digital transformation and regulatory complexities.

Access detailed insights into the company’s market position

https://www.databridgemarketresearch.com/reports/global-fraud-detection-and-prevention-market/companies

Alternative Research Questions for Global Fraud Detection and Prevention Market Market Analysis

- What is the current market valuation of the Fraud Detection and Prevention Market Market?

- At what CAGR is the Fraud Detection and Prevention Market Market projected to grow?

- Which are the top-performing product categories in this market?

- Who are the emerging players in the Fraud Detection and Prevention Market Market?

- What regions are witnessing rapid demand in the Fraud Detection and Prevention Market Market?

- Which countries show significant market potential?

- What are the major driving factors behind this Fraud Detection and Prevention Market Market growth?

- How has the Fraud Detection and Prevention Market Market changed over the past five years?

- What are the opportunities for new entrants?

- What is the competitive landscape of the market?

- What technological advancements are influencing the Fraud Detection and Prevention Market Market?

- Which segment holds the largest market share?

- What partnerships or collaborations are influencing the Fraud Detection and Prevention Market Market?

- What is the role of e-commerce in driving sales?

Browse More Reports:

Global Laser Plastic Welding Market

Global Medical Aesthetic Market

Global Smartwatch Market

Global Titanium Market

Global Water Purifiers Market

India Baby Care Products Market

India Smart Water Meter Market

India White Goods Market

Saudi Arabia Glass Market

Global Additive Manufacturing Market

Global Digital Banking Market

Global IP-VPN Web Hosting Service Market

Global Mobile Money Market

Malaysia Elderly Care Market

Global Energy Drinks Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"